Sustainable Investment Outlook 2025

A round-up from major investment firms on what to look out for

Dear readers, Happy New Year!

As we enter 2025, the first post of the year will look ahead to key sustainable investment themes identified by major investment firms. This will not only help us focus on important areas for this year but also uncover opportunities amid a more challenging political environment.

If you are pressed for time, here’s a quick summary:

Physical risks and insurance will play an increasingly critical role as mitigation efforts have not caught up fast enough and damages from natural disasters rise

Growth areas in major asset classes:

Equities: Passive investments through transition and ESG ETFs are expected to expand

Bonds: The issuance of sustainable bonds expected to rise further in 2025

Private assets and blended finance1

Evolving regulations to shape sustainable investing landscape. Europe’s Corporate Sustainability Reporting Directive (CSRD) mandates large companies to release ESG information in 2025

Transition investing will be a key trend (mentioned multiple times!)

AI will continue to play a major role as energy demand grows

Emerging areas of interest: natural capital, biodiversity and water

If you are interested in finding out more, please read on. The links to each investment outlook can be found below as well.

Let’s begin!

BlackRock

The world’s largest asset manager was in the headlines early this year for leaving the Net Zero Asset Managers Initiative, a move seen as a step back from climate initiatives amid rising political pressure.

Understandably, the asset manager did not publish an investment outlook specifically focusing on sustainable themes but mentioned transformation and transition in its 2025 investment outlook. Specifically, it highlights that financing the future is not “just about the rise of AI and its buildout via data centers. Meeting growing energy demand (think solar farms, power grids, oil and gas) will generate investment of US$3.5 trillion per year this decade”.

Another theme highlighted under transformation is the growing role of private markets — also noted by Schroders (see below).

Schroders

Schroders published its 2025 sustainable investment outlook in early December last year, focusing on eight trends for North America. While I won’t list them all, the key highlights for me are:

[1] New ways to define and measure sustainable AUM and flows: As fund-naming rules become more stringent and as more investors incorporate sustainability criteria into their investment process, there is a growing need for new methods to track funds that may lack sustainability labels but are still aligned with sustainable goals.

[2] Increased focus on the physical risks and the role of insurance: This is particularly timely, especially as news of the LA wildfires dominated headlines. Schroders expects this area (and the role of insurance) to become increasingly important as mitigation efforts are not progressing quickly enough and as natural disasters cause billions of dollars’ worth of damages.

[3] Further focus on thematics: Beyond generic ESG, sustainability-minded investors will become more specific in seeking alpha opportunities. These include technology and innovation (AI — of course), health & wellness, sustainable infrastructure and resource security, and the circular economy.

[4] Emerging focus on natural capital and biodiversity: Schroders acknowledges that “actual investment dollars moving into this area are still quite scarce”, but it has observed increased client interest in areas like regenerative agriculture, forestry, and water conservation.

[5] Increasing focus on private assets: Private assets are expected to play a bigger role in sustainability goals as more investors include them in their portfolios. Decarbonization in private markets is one of the key themes in focus here.

Invesco

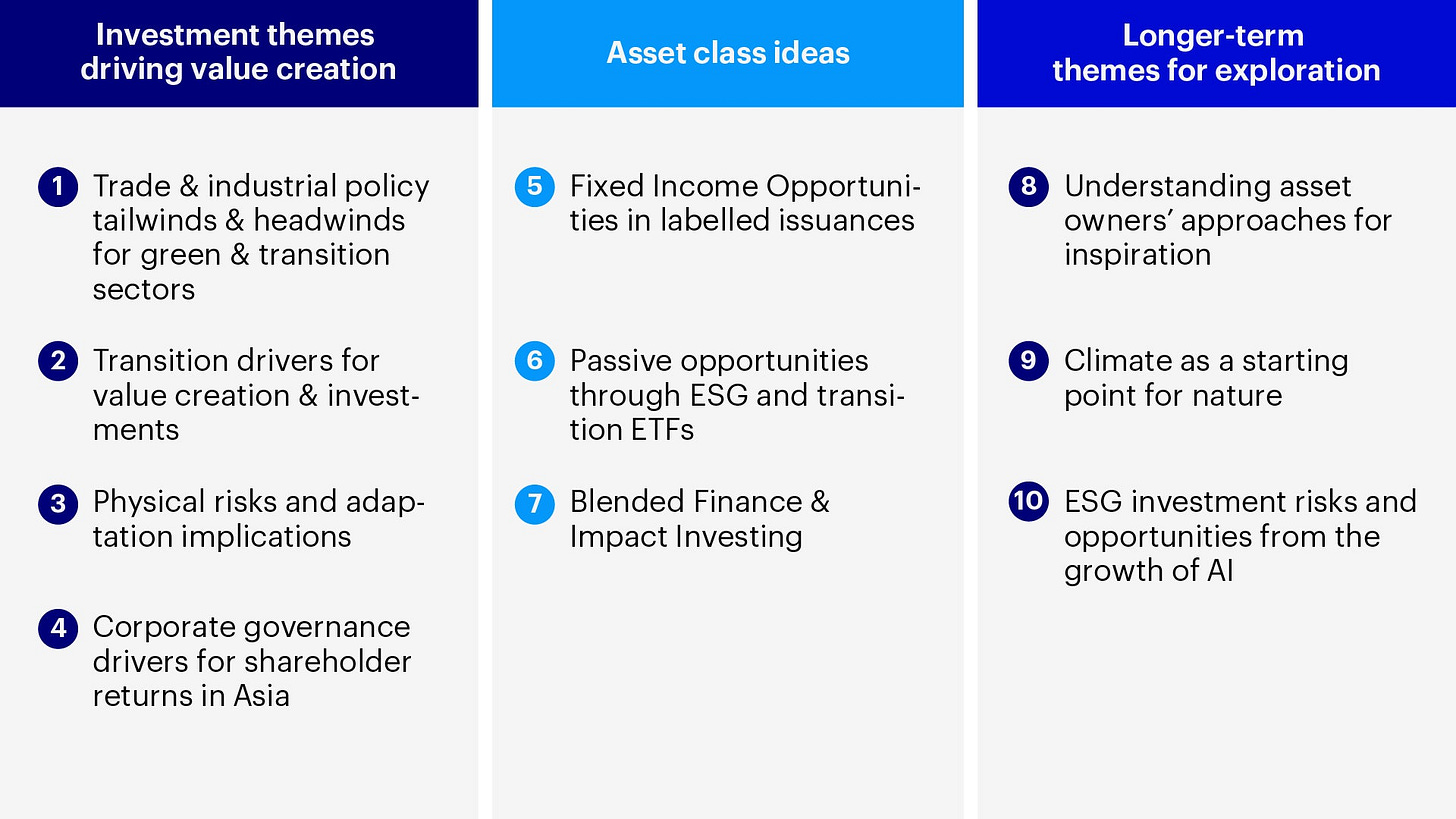

Invesco’s outlook for 2025 focuses on the three pillars below, namely value creation, asset class ideas and longer-term themes.

Under value creation, one major regulation highlighted is the Carbon Border Adjustment Mechanism (CBAM) in EU, which states that from 2026 onwards importers of goods such as iron, steel, cement and aluminium will have to pay a carbon tax. This will mean that costs of imports will be less competitive compared to EU producers. It also mentions that “climate transition will create market opportunities for new technologies (such as sustainable aviation fuel or green steel)”.

Another interesting one is the corporate governance drivers in Asia, although it seems we may have heard this before, with reform efforts in Korea falling behind expectations.

In terms of asset class ideas, one may continue to expect more issuances of sustainability-labelled bonds, which reached US$554 billion in H1 2024 (a 7% year-on-year gain). Passive opportunities also represent an interesting asset class, offering investors a cost-effective way to customise their ESG exposures (see this post for a case study on GPIF).

As for longer-term trends, we see the usual suspects in biodiversity and AI, both touted for their potential to drive long-term growth in sustainable investing.

Robeco

Robeco’s 2025 investment outlook has a few sections on sustainable investing. It expects (correctly) that the next US leadership will withdraw from the Paris Agreement and reduce support for green industries, “hindering but not halting” progress towards global sustainability goals. Given the new administration, Robeco adopts a cautious tone for 2025:

Heading into 2025, our base case scenario of economic uncertainty and unpredictable financial markets may lead some businesses and investors to deprioritize sustainability in the short term. Nevertheless, the long-term trend … is well established.

Robeco also expects European companies to maintain the lead over US and Asian companies in terms of ESG ratings, especially as Europe tightens reporting regulations.

Transition investing, meanwhile, is an area that Robeco anticipates will experience rapid growth, as this is increasingly being recognised as an area of sustainable investing. Example strategies include those that support the transition to a low-carbon economy.

UBS

The Swiss investment manager’s outlook struck a rather positive tone, believing that sustainable investing strategies are likely to benefit from lower rates and broader equity participation in 2025. It also highlighted the positive performance from sustainable strategies — particularly ESG leaders — in 2024.

Other key themes include the shift to impact and transition investing, a resurgence of social themes, the continued rise of global green bond issuance, and rising energy demand driving renewables.

Allianz Global Investors

Allianz Global Investors highlighted five key themes to watch in its sustainable investing outlook for 2025. Similar to other firms, they included tackling climate impact from record temperatures and natural disasters, along with the raft of new regulations coming from Europe. What is rather unique is its mention of the ongoing conflicts and changing priorities for the US that may impact defence spending.

Allspring

The investment management firm spun out of Wells Fargo published its sustainable investing outlook in early January. Key takeaways include:

Expanding nuclear power initiatives to meet growing need for clean energy. This involves restarting existing reactors and buildings small modular reactors (SMRs).

More extreme weather is adding risk worldwide, leading to increased exposure for insurers (this sentiment is similarly echoed in several outlooks mentioned above).

Demand for clean water is rising as sources are shrinking. This is a unique point that may be worth watching.

Cambridge Associates

The private equity consultant’s 2025 outlook also has a focus on sustainable investing. In particular, it expects the California Carbon Allowances to recover their 2024 losses in 2025 due to the carbon allowance programme’s built-in tightening path and the timing of supply reductions. Additionally, it anticipates that strategies with faster distributions will likely attract more impact investing flows, as the challenging market environment may lead allocators to favour “quicker-to-validate-and-exit” models.

Summary

2025 is likely to see a more cautious sentiment for sustainable investing amid a more challenging political environment and tighter regulations in Europe. The focus this year will likely be on physical risk and insurance. Meeting growing energy demand (either through hydrocarbons or renewables such as nuclear) is another key theme. Transition strategies, passive investments, sustainable bonds and private assets could represent significant growth areas.

Given the broad universe of investment firms, it is impossible to cover everything, so this is definitely not an exhaustive list and is meant to serve as a barometer for 2025. As always, please feel free to comment or reach out if you notice anything that I may have missed!

Disclaimer: These investment outlooks are for informational purposes only and should not be construed as investment advice.

Defined as the use of public capital to enhance private capital in sustainable investments