Where to find ESG investing jobs? (2023 edition)

Sharing an analysis from a popular ESG job board

[SEP2024 UPDATE: Reader John kindly pointed out the job board website is no longer in use. If anyone has any information/insight on this feel free to let me know!]

With COP28 dominating headlines and as we are nearing the end of the year, perhaps one of your New Year resolutions is to find an ESG investing job.

Where do you start?

This website, esginvestingjobs.com, is a great starting point.

This week, I will share some analysis1 of the job postings on this website to break down where these jobs are, what these jobs do, and who employers are looking for.

Let’s begin!

Where to find ESG investing jobs

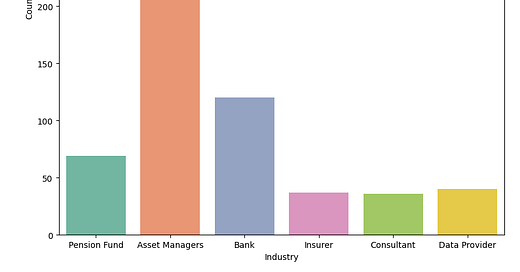

To answer the question of where to find these jobs, we can break down the job postings by industry.

Perhaps not surprisingly, the highest number of postings came from Asset Managers, whereas postings from Consultant ranked the lowest:

Given ESG investing is essentially an investing job, it should not be a big shock that it is the asset managers that are looking for talents in this field. The job profiles range from incorporating ESG principles in the investment process to working for a specialist asset manager looking for impact investing opportunities. If you want to have a higher chance of breaking into the industry, asset managers may be your best bet.

Breaking down by geographies, we see that US and Europe dominate job postings — perhaps also an unsurprising finding — given that ESG investing is relatively more mature in these regions. There are not that many job opportunities in Asia, with most listings coming from the usual financial hubs such as Singapore and Hong Kong. There are also more than a couple of postings looking for candidates in Mumbai.

What do ESG investing jobs do

Without scraping the website data, let’s start with some of the more recent job postings to check out the job descriptions.

One way to do this is via the RSS feature on the website to pull information on some of the more recent jobs and analyze the job descriptions. I highlighted some of the more common themes observed across jobs:

Identifying and assessing impact investment opportunities spanning across several sub-sectors and asset classes

enhance Environmental, Social, and Governance (ESG) solutions and advance stewardship efforts

contribute to the development and implementation of stewardship objectives, primarily in the areas of thematic engagement and proxy voting, ensuring alignment and consistency with our firm’s sustainable investing goals and conducting analysis on the engagement and proxy voting outcomes.

Tracking and analysing metrics related to the social and environmental impact of investments

Build-up ESG and Climate industry expertise to guide client in integrating ESG and Climate research into their investments processes

Use information from proprietary key performance indicators and proprietary research to score, analyze, rate and rank companies on their ESG performance

Deliver investment and sustainable outcomes for clients

Support global ESG reporting requirements

Provide compliance advisory support to sustainable & transition product development

One key thing to point out is that the job function is dependent on the industry as well. For instance, an asset manager focusing on impact investing is more likely to look for candidates who are able to screen impact investment opportunities, whereas a role with a data provider would involve working closely with clients on integrating ESG data solutions.

There are also research functions that incorporate ESG metrics to rank and score companies. On the risk and compliance side, there are opportunities for candidates who can help companies meet global sustainable reporting requirements.

Who are employers looking for?

Having had a sense of the job description of an ESG investment analyst, what are the qualifications that employers are looking for?

Here is a non-exhaustive list, focusing only on ESG-related qualifications (i.e., I am not listing the generic ones such as one should be a self-starter/ have strong communication skills etc.):

Bachelor’s degree required; Master’s degree in finance, economics, sustainability, or related field.

Experience with ESG related data providers such as MSCI, Bloomberg, Sustainalytics, ISS, Aladdin etc. and/or ESG disclosure organizations such as PRI, TCFD, SBTi, CDP, etc.

Knowledge of sustainable investing and the asset management landscape.

Good understanding of how ESG and Climate factors impact financial markets.

If some of the points above sound a bit disheartening (especially if you are only starting out in this field), do not despair. There are also quite a number of job postings that do not explicitly mention requirements of deep knowledge in sustainable finance. Core skills in finance (corporate finance, deal making, analyzing balance sheets) remain in demand.

Another category worth looking at would be to break down the job postings by seniority levels. As one may expect, there are more postings at the Junior and Intermediate levels:

Not a lot of Executive job postings out there. But then again, the search for executives is probably done at a different level by executive headhunters. Nonetheless, it is quite interesting to check out some of the titles at this level:

Chief Investment Officer

Sustainable Investing — Chief Administrative Officer

Head of Responsible Investing

Head of Impact Investing

Head of ESG Strategy

Most of these jobs would require up to 10 years of experience in sustainable investing. But again, do not be discouraged, there are plenty of postings at the Junior and Intermediate levels to start accumulating the relevant experience.

Summary

After looking through a number of the job postings, I get a sense that a lot of the job requirements on ESG expertise are still not very specific. Yes, one is expected to have some knowledge of sustainable investing and how ESG factors affect investments, but there are not really a lot of standardized ESG certifications that could signal that. While there were mentions of the CFA ESG investing certificate, this is usually “desirable but not essential”.

Going back to the very first post when I started this substack in May, the field of ESG finance is filled with a lot of acronyms defining standards, climate scenarios and the various reporting frameworks, which may seem daunting2 to anyone wanting to learn more.

But to become a successful ESG investor, the domain knowledge in ESG alone may not be sufficient, the core part of the job — investing — is still key.

With that in mind, I believe it may be easier to break into the field if you are a good investor but a beginner or novice in ESG — than the other way around.

With that said, given the diverse industries represented in the field from data provider to asset managers, there are plenty of opportunities for a keen individual to find a suitable ESG investing job. as long as you are able to pair your strengths with what the employer is looking for.

I hope you find what you are looking for. Good luck!

Data retrieved as of Dec 3rd, 2023.

In some cases, this might even be a turn-off to some.

Do you know if/why the website shut down?