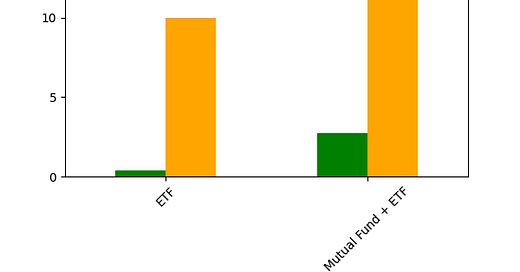

In part 1, we saw that ESG ETF assets (at $360 billion) represent 3.6% of total ETF assets (estimated at $10 trillion using 2021 numbers).

What if we extend this analysis to also include mutual funds? Before we go on, here is a quick poll:

For this analysis, we turn to investment research firm Morningstar, which specializes in the rating mutual funds in the asset management industry. For those not familiar with Morningstar, they are well-known name in this space and funds that receive a favorable Morningstar rating often attract more monies.

In Morningstar’s Global Sustainable Fund Flows report, we saw:

Global sustainable fund assets continued their recovery to hit $2.74 trillion at the end of March.

Using Morningstar again as a source, we estimate global mutual fund assets at $40 trillion, which translates to a 6.85% market share.

In short, while we are seeing a lot of ESG-related headlines, the proportion of money allocated to ESG-labeled mutual funds or ETFs is simply not a lot when we compare them as a proportion of total fund assets (green is ESG, orange is universe):

ESG growth may have been significant in the past few years (ESG ETFs could grow at a 35% annual rate according to this Bloomberg Intelligence report), but there is still a long way to go to even reach 10-20% of total assets.

Before ESG enthusiasts jump in to object that the 5-10% proportion is too low, it is worth pointing out that depending on how you define ESG integration, your answer may be very different.

For instance, in the 2020 report by the Global Sustainable Investment Alliance, the amount of sustainable investment assets is reported at a staggering $35.3 trillion, which we assume to include all asset classes beyond just ETFs and mutual funds. This translates to the statement that 35.9% of total AUM are sustainable investments:

Going back to the poll above, I guess you can say you are right if you choose 5-10% or 30-40%, again highlighting how polarizing this topic can be.

But surely, one answer is more right than the other? Or maybe the right answer, like always, is somewhere in between.

Looking back at Morningstar’s definition of sustainable funds, we see that:

The global sustainable fund universe encompasses open-end funds and ETFs that, by prospectus or other regulatory filings, claim to focus on sustainability; impact; or environmental, social, and governance factors.

Our universe of sustainable funds is based on intentionality rather than holdings. For example, a portfolio can score well on ESG metrics such as the Morningstar Sustainability Rating, but if ESG issues are not the focus of the fund's investment strategy, it will not be included in our universe.

I like the emphasis on ‘intentionality’ above. Let us say that if we are only looking at funds that ‘intentionally’ invests in ESG, we are looking at a 5-10% range; when we loosen that definition to let in ‘all kinds of ESG integration’, we are talking about 30-40% range of total assets.

Why does this matter?

In asset management these days, classifying your fund as ‘we pay zero attention to ESG considerations’ is akin to suicide and saying goodbye to potential inflows1. This resulted in a world where most managers claim they integrate some form of ESG in their investment process.

If we are really looking at ETFs or mutual funds that deliberately tilt their portfolios or make investment decisions that favor a better ESG outcome, the percentage of assets is probably much smaller that one may actually imagine.